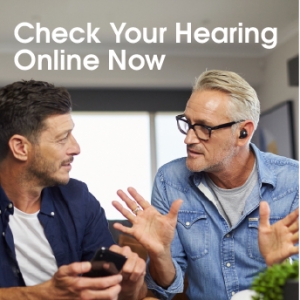

Nuheara Ltd (NUH.ASX)

Smart earbuds – not just novelty but solving problems now

Click here to download this report from Foster Stockbroking in PDF format, or continue reading online below ![]()

Event:

We initiate coverage on Nuheara Ltd (NUH).

Investment Highlights:

NUH is a wearable hearing technology company, its major product being IQbuds. These are wireless earbuds possessing Bluetooth connectivity and offering hand-free calls, streaming of music, assisted listening, sound control, noise cancelling and ability to personalise a user’s experience.

We have compared IQbuds to key competitors, and believe its major point of differentiation is its ability to allow dynamic control of sound – both digital and physical – over a wide range, as opposed to simple off or on noise cancellation. IQbuds also can elevate speech as an assisted listening device. We believe only Doppler Lab’s yet to be shipped Here One may be comparable.

We expect IQbuds customers to primarily fall into two segments. First are consumers who want to connect with devices without wires or hands, and desire the compactness of earbuds, and there being less conspicuous and socially isolating than headphones. Second there are those which suffer some hearing loss, who may not yet be ready – or desire – a hearing aid but want a device that is more “cool” and can improve their listening, especially in noisy environments.

Various sources forecast the hearables market to reach between US$17b and US$43b by 2020. The majority of the market is still expected to be comprised of headphones and hearing aids, with earbuds accounting for only ca. US$6b by that time. Strong CAGR is underpinned by the replacement of wired by wireless, hearing loss, and desire of hand free smart devices.

Hearables not just novelty but solve real-time problems. Pebble’s and Fitibit’s recent struggles highlight that as novelty diminished for some wearables, it has unmasked their shortcomings, notably lack of immediate gratification and reliance on data analytics. However hearables such as IQbuds enhance the sensory experience and solve problems (difficulty hearing) in real-time.

IQbuds to ship by end 2016. During 2016 NUH ran a pre-order campaign that generated over 4k pre-orders (>$1M). The company selected world class Flextronics as contract manufacturer and expects to start shipments end 2016. Hard launch will be at the Las Vegas CES in January 2017. NUH signed major US distributor Wynit for the US, whose client include Best Buy and Walmart.

Foster Stockbroking is engaged in providing corporate services to NUH for which it may earn fees. Foster Stockbroking was Joint Lead Manager in the $5.0M placement of 83.1M NUH shares at $0.06 in September 2016. Foster Stockbroking received fees for this service.

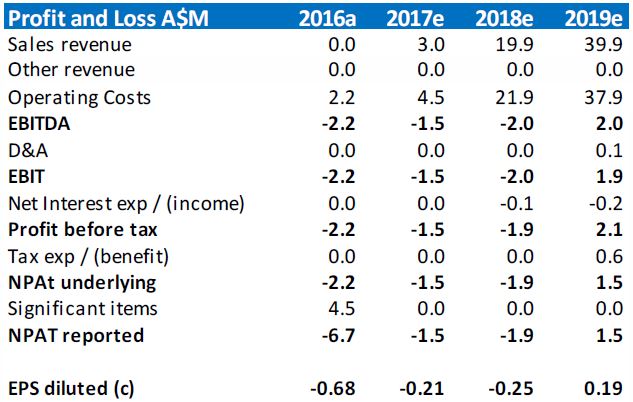

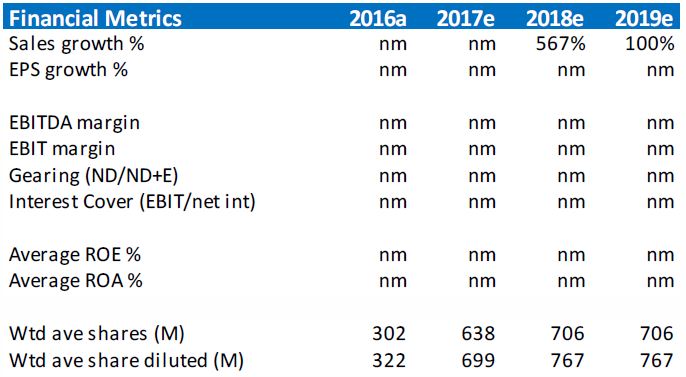

Earnings and Valuation:

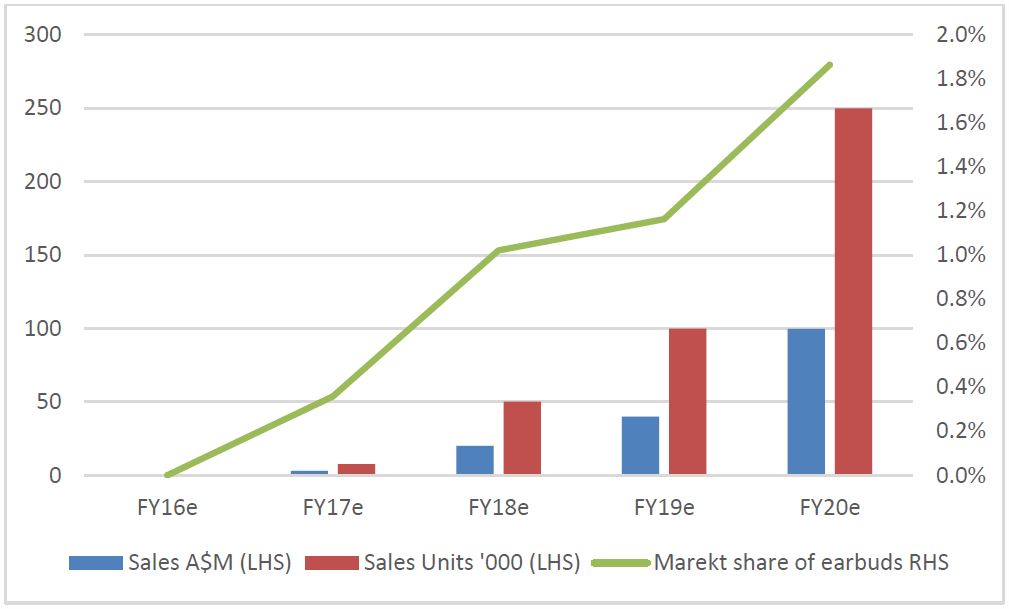

We forecast NUH to generate losses in FY17e and FY18e as it ramps up sales, and forecast maiden NPAT in FY19e of $1.5M.

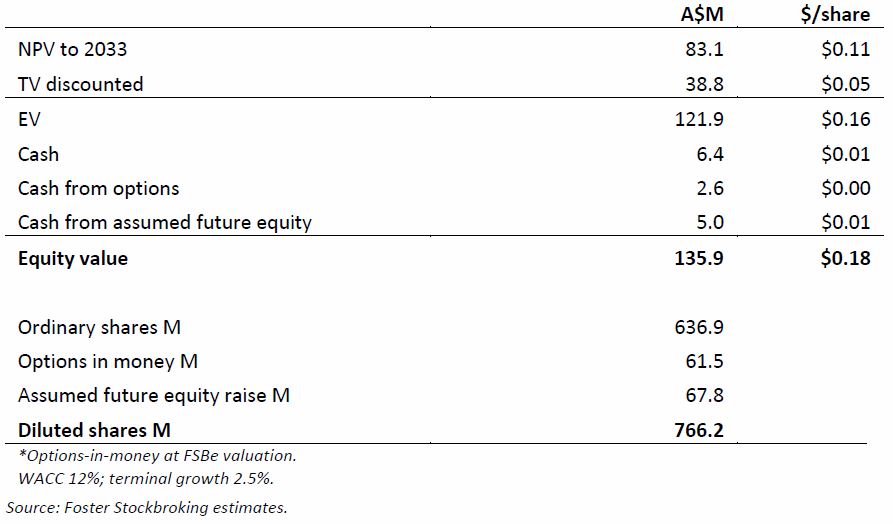

We value NUH at $0.18/share by DCF using 12% WACC, terminal growth rate 2.5%, long-term FY21e EBIT margin 15% and assuming ca. 2% penetration of the earbuds market. We assume earbud market itself to be 14% of total hearable market.

Recommendation:

We initiate on NUH with a Speculative Buy rating and price target of $0.18/share based on our valuation. Catalysts include first shipments; first sales; positive product reviews; and further distribution deals.

Nuheara Ltd (NUH)

Full Year Ended 30 June

Source: Company; Foster Stockbroking estimates

EARBUD PROVIDER TAKING ADVANTAGE OF BURGEONING HEARABLES MARKET

Introduction

Nuheara Limited (NUH) is a wearable hearing technology, or hearables, company collocated in Perth and San Francisco that has developed an intelligent wireless earbud with multiple uses – IQbuds.

NUH’s business originally commenced as a research project in 2014, with the founders David Cannington (Executive Sales & Marketing) and Justin Miller (CEO) drawing on their experience in hearing technology commercialisation along with technical advice and research and modelling from chief scientists Prof. Sven Nordholm and Kevin Fynn in their respective fields of digital signal processing (DSP) and electronics at Curtin University. The company was incorporated in 2015, and listed in March 2016 on the ASX. A prototype of IQbuds was developed during 2015 and 2016, and NUH is now targeting commercial production end 2016.

NUH’s HEARABLE INNOVATION – IQbuds

What are IQbuds?

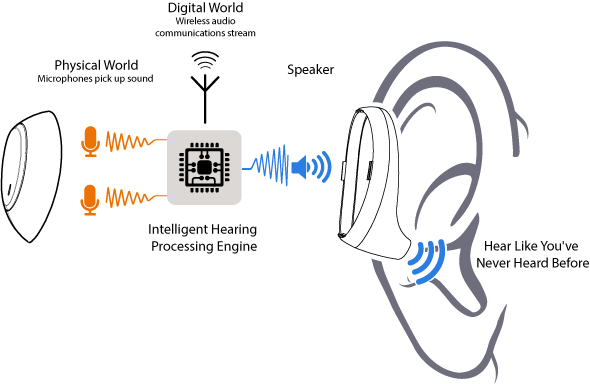

IQbuds are two tap controlled earbuds that fit into the ears. The IQbuds are miniature computers that process sound, allowing users to control and enhance their listening experience. Each IQbud contains three multi-layer electronic boards, three microprocessors, two microphones, two antenna, battery, speaker, and tap-touch controller. The IQbuds come with a charging case. Retail price of the IQbuds is US$299.

Figure 1: IQbuds and Charging Case

IQbuds are wireless and possess Bluetooth connectivity, allowing the user to stream music, make hands-free phone calls, and listen, communicate and connect to both their digital and physical worlds without the use of any cables. NUH provides a smart phone app, which will provide users the ability to augment hearing based on their personal preferences, while simultaneously enabling connectivity to voice-enabled smart devices such TVs and other internet-of-things (IOTs).

We believe the fundamental attraction and differentiation of IQbuds is its adaptive augmented hearable technology – allowing consumers to control what they hear. This includes the ability to control and mix ambient sounds with digital devices audio in a range of day-to-day consumer situations. IQbuds are an assisted listening device, Bluetooth earpiece, and noise cancelling headset all in one product, all the time the consumer controlling experience via app and tap functionality on earbud.

IQbuds – truly multi-functional and intelligent

The IQbuds’ multiple features stem from what NUH has observed has happened in headphones, hearing aid, and Bluetooth markets.

- Hands-free calls. Via bluetooth processor and no wires, IQbuds connect with both iOS and Android enabled mobile phones, providing hands-free phone calling. Can also be interconnective with other smart devices.

- Hands-free high fidelity music. IQbuds’ speakers offer stereo sound quality for music, video, podcasts, audiobooks, and other audio streams utilising bluetooth.

- Noise cancelling. Based on noise reduction techniques available today, the ear buds can suppress background noise.

- Sound awareness control. Utilising multiple external microphones, IQbuds allow users to be aware of external surroundings (physical world – e.g. cafes, restaurants, street, concerts, events, airplane, gym, bar, club) as well as digital streams (digital world – smartphone, tablet, TC, laptop, PC) and to control the mix from these two streams. For example still being attuned to the sounds of the outside world while streaming music. In essence the IQbuds can work like a sound mixer or equaliser.

- Tap touch control. Users can answer phone calls, start/stop music, switch between physical and digital worlds, and adjust hearing modes via tap and touch control function built on the earbuds.

- Hearing boost. IQbuds can provide hearing boost to users so that they can hear more clearly in challenging and noisy environments, elevating speech over background and suppressing or cancelling unnecessary sounds.

- App controlled allowing personalisation. NUH app allows users to adjust, personalise, and save individual IQbud settings. The app is compatible with both iOS and Android. Based on pre-programming profiles, NUH’s app allows user to control and save hearing settings based on preferences. Hearing boost, noise cancellation and awareness control can set through personalized settings.

- Stylish and comfortable design. The IQbuds were designed by third party industrial designers to make them aesthetically appealing, and appear cool, removing the stigma of hearing aid. They also should fit most ears securely and comfortably.

- Convenient charging case. The dual purpose storage and charging case is small enough to fit in user pocket or purse, plus contains a charging on the go function for earbuds.

- Extended battery life. IQbuds last up to 4 hours with continuous wireless streaming, while the charging case provides three recharges of 4 hours each, extending total on-the-go battery life to 16 hours

SINC Technology provides IQbuds with intelligent hearing experience

NUH claims its main point of difference is its own developed Super Intelligent Noise Cancellation (SINC) technology. It uses multiple microphones and an intelligent hearing processing engine to select and filter sounds transmitted to the ear, which can be adjusted or personalised by a user through the NUH’s app. Based on the DSP experience of Curtin University and NUH, multiple microphones and processing techniques provide users ability to hear more clearly in more challenging environments.

Figure 2: Nuheara’s SINC technology

IQbuds’ key feature is SINC – Super Intelligent Nosie Cancellation – enabling user to adjust and personalise sounds.

Future upside in new products and upgrades

NUH has released a software development kit to third party app developers which should accelerate product enhancements. These could include translating languages on the fly; personal tour or sightseeing guide; and medical or fitness coach prompting through analysing sensors.

Other future advancements NUH may develop include longer life with battery technology improvement and inclusion of in-ear sensors to monitor biometrics such as pulse, blood pressure, temperature, and external sensors to monitor and record environment all conditions e.g. location.

INTELLECTUAL PROPERTY

NUH has developed proprietary hardware, software, and processing techniques to deliver its multi-functional audio technology and platform. This includes unique speech augmentation software with spatial directionality and placement, Bluetooth connectivity, and app software components. To date the company’s intellectual property (IP) mostly consists of trademarks and secrets. While a number of patents are pending, most of the unique technology – including SINC – is protected by trade secret.

THE HEARABLES INDUSTRY

What are hearables? Wireless, wearable, and connective listening

“Hearables are miniature computers that can be worn in ear that are wireless. It includes headphones, hearing aids, and earbuds.”

Hearables is a term attributed to both Nick Hunn of WiFore and Apple (at around the time of its Beats acquisition) in 2014. At a rudimentary level refers to a wireless, miniature computer that can be worn in-ear, processing sound to enhance the wearer’s listening experience. Hearables can include earbuds, headsets, headphones, and hearing aids.

Smart hearables are those containing intelligent features, some which allow the user to control external sound, monitor fitness, connect with other devices. In the future hearables may perform roles, like language translator, tour guide, and personal medical assistant, as well as assist in other activities in a voice enabled world (witness the film Her).

Arguably old style hearing aids and wired, bluetooth-less headphones – technologies that have been around for decades albeit for specific narrow consumer segments and applications – were predecessors of hearables, save for lack of connectivity and prevalence of cables. The Sony Walkman – another predecessor – introduced portability, music-on-the-go, and headphones to everyday life, suddenly greatly expanding the consumer base.

However the onset of wireless headsets in early 2001 and the acceleration of wireless headphones in early 2013 began to see the arrival of hearables as we understand it – wireless and connective. This was driven in part by desire to connect to smart devices (IoT), and partly by wanting to dispense with cables and wires that would always at one stage get in the way of operating devices.

AirPods puts focus on earbuds as hearables

“The arrival of Apple’s AirPods signals a momentous step for hearables for the mass market.”

The launch of the iPhone 7 in September 2016 was a momentous step for hearables industry. But it was not the phone, it was the concomitant release of AirPods – Apple’s entry into the wireless intelligent earbuds space. While not the first to market, it certainly has brought it to the consciousness of the mass market while removal of the headphone jack. It signals the ascendancy of wireless headsets, headphones, and earbuds.

HEARING AIDS, EARBUDS, AND HEADPHONES FORM HEARABLES LANDSCAPE

Breaking down the hearable segments

We have segmented hearables into five segments, following from WiFore’s own analysis. These comprise Headsets; Headphones; Earbuds; Hearing Aids; and Industrial. We examine three of these major categories:

Wireless headphones now outsell wired.

Headphones – Wireless now outselling wired

These include expensive noise cancelling utilising advanced digital signal processing headphones that can be priced > US$300). US Bluetooth headphone sales overtook non-Bluetooth headphone sales for first time in 2016, and grew 42% YoY while the total category grew only 7%. Bluetooth headphones accounted for 54% of sales, and 17% of volume of total headphones. Source: NPD Group’s Retail Tracking Report.

Dominated by major brands. Being consumer orientated products, the headphones are sold via broad distribution channels. Major providers include Monsters; Jabra; Bose; Intel; Panasonic; Bang Olufsen; Skullcandy; Shure; JBL; Beats; Samsung; Sennheiser; Klipsch; Sony; Polar; Apple; Google; Motorola; and LG. Many headphones offer noise cancellation, long battery life (5 to 40 hours); tap touch control buttons; music streaming, and hands free calls. Given the presence of major brands, it is more challenging for headphone startups. For example US$30M raised for earbuds over past few years vs only US$14M for headphones. Source: WiFore.

Hearing aids are adopting bluetooth connectivity.

Hearing aids – Concentrated industry recently entering the field

This segment is dominated by six companies which market products designed to correct hearing impairment for users with hearing loss. Products comprise advanced processing and packaging, are expensive, regulated, covered by insurance, and customised to patients’ hearing loss. Hearing aids ring fence their products as medical devices – selling them through qualified audiologists and clinics, keeping prices high and divorcing the consumer from purchasing decision, although audiologists to test, tune, and adjust device to for user’s particular hearing. Some of the major providers are now offering wireless connectivity and Bluetooth in their hearing aids. These companies include ReSound, Oticon, Starkey, and Beltone.

Assisted listening devices. Some companies entered market by circumventing doctors and marketing themselves as assisted listening devices. There are hearing aid-like products to assist hearing in specific situations such as watching TV or listening noisy social setting, which are non-medically certified personal sound amplification devices in price range US$200 to US$500. Many are sold through internet or print pages aimed at those hearing loss usually aged 60+ years and do not want to go through medical practitioner/audiologist route. Include Soundhawk and Sound world.

Earbuds as hearables are latest entrant to the market.

Earbuds – Newest entrant to market

Earbuds have a distinct advantage over headphones in their portability and compactness Comprises mostly new start-up companies at early stages of development or commercialisation including NUH – as well as some established multinationals. The number of features in each earbud vary greatly.

Many earbuds feature Bluetooth, some basic form of noise cancelling, and ability to stream music and take hands-free phone calls. The best among the smart ear-buds offer speech enhancement and layering digital audio over real-world sound as the key differentiating factor. This is where IQbuds fit in.

Competitors to IQbuds include Apple’s AirPods, Samsung’s Icon X, Bragi’s Dash and Doppler Lab’s Here One.

Earbud Manufacturer Competitors

Smart earbuds have only been launched recently in the market. The initial response has been encouraging with Bragi selling 100k pieces in the first 6 months since launching in 2016. While there are earbuds in the market we believe that NUH, along with a handful of competitors, are likely to differentiate themselves ahead of the rest. In terms of the key players we note the following in addition to NUH:

- Bragi: Dash. The company Bragi, based in Germany, offers the Dash earbud. This is targeted mostly to the sports and fitness market. Bragi has already sold 100k Dash sets, after launching in 2016. Features include wireless audio; 3 hours battery life extendable to 15; US$299 price; tap-touch control; sensors with audio feedback on heart rate, steps; app; compatibility with iOS, Android; and Windows. Bragi has established a brand quickly and was one of the first earbuds on the market to embrace multi-functionality and be truly connective and wireless.

- Samsung: Gear IconX. Like Bragi’s Dash, Samsung’s Gear IconX is targeted to the fitness segment. Samsung was one of the first major multinationals to step into the earbud hearables market. Features wireless audio; 3.8 hours battery life extendable to 7.6 hours; awareness control; tap touch; sensors including activity tracker and voice guide; internal memory and storage; app; compatibility with iOS; Android.. Priced at US$279.

- Apple: AirPods. The iPhone7 launch heralded Apple’s much awaited entry in the wireless hearables market with the removal of the headphone jack and the AirPods. Features include wireless audio; tap; automatically recognition of speaking; 5 hour battery life extendable to 24 hours; music streaming; connect automatically to all Apple devices; reduction of background noise when speaking and IR sensors that detect when in ear and automatically play music. Price US$159.

- Doppler Labs: Here One. San Francisco based Doppler Labs is developing a smart ear bud called Here One, which it expects to ship March 2017, and is a follow up a the much more basic Here earbud. Features include adjustment of ambient sound; wireless audio; real world sound control; hands free calls; smart noise filters from different directions; speech amplification; tap; selective noise cancelling; layered listening. 3 hours battery life extendable to 6 hours. Price US$299. From what we gather from previews of the device, it has focus similar to IQbuds in terms of mixing and controlling sounds.

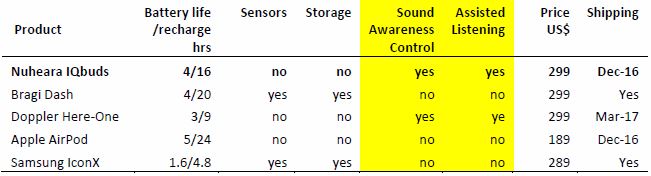

Figure 3: Competing products to IQbuds

There are numerous other competitors in earbuds as hearables including Jabra, Earin, Ripplebuds, and Truebuds to name only but a few.

IQbuds – POSITIONED TO BE A LEADER IN CONTROLLING SOUND

We expect IQbuds to be positioned as a leader in terms of dynamic sound control – including how you mix physical and digital sounds.

We have compared what we see as five leading earbuds, including IQbuds, in Figure 4.

All of the earbuds have recharging cases, offer Bluetooth wireless streaming of music, functionality with app, and ability for hands-free calls. Where it is trickier to compare – and where we envisage there will be differentiation products – is in the management of sound which we have dubbed “Sound Awareness Control”. All have some basic noise cancellation where ambient sound can be turned down if listening to music or taking a call – i.e. basically an either “on” or “off” mode.

But in terms of ability to manage and control sound over a spectrum of situations, we believe that only IQbuds and Doppler Here One provide this experience to the user. i.e rather than simple on or off noise cancellation, they provide more of dynamic continuous control. In terms of assisted listening, such as amplifying speech, again we believe that only IQbuds and Here One are the only viable earbuds. We can only gather this information from limited previews of the devices and we must wait until each is shipped to observe full functionality. This is especially so for the Here One, which is still some months away from shipping vs the immediate shipping of IQbuds.

We believe that only Doppler Lab’s Here One – yet to be shipped – can compare to NUH’s sound control and assisted listening.

Overall we believe that IQbuds and Here One will be positioned – and sought after – for their “premium” sound quality, flexibility, range and control. One audiologist’s review of the IQbuds found them to have crisp and clean sound, without harsh high frequencies, and retaining full 3D (spatial) situation awareness.

Bragi Dash and Icon X, with their biometric sensors, have unsurprisingly targeted active consumers focus on fitness, frequent the gym, run, walk, jog, cycle, or swim. In some ways this is tougher competitive space given that many wrist wearables also compete in this field. However for the purely sound control experience – which IQbuds and Here One offer – wrist wearables do not compete.

Figure 4: Comparison of IQbuds with Peers

Bragi Dash and Icon X have received mixed review re latency, battery life, and sound quality. We expect IQbuds will perform better.

Quality of sound, battery life, and latency key issues of existing earbuds

Reviews of the products already in the market – such as the Bragi, IconX, Earin — by the key tech websites (e.g. Wired, Warebles, TechRadar, PCMag) have been mixed. While reviewers on the whole were impressed by the functionality, they found the buds most wanting on three key issues: Sound quality (such as hissing), latency (sound chopping in and out, Samsung), and battery life (too short, especially Iconx).

We expect IQbuds will perform better

We expect IQbuds should perform much better across these three issues, especially its focus on sound quality and control. A problem of Bragi and Icon X is trying to be all things to everyone, and we suspect inclusion of the biometric sensors has compromised their sound quality. IQbuds’ battery life is comparable to Bragi and markedly better than Icon X and Here One.

Management and R&D experience should drive future improvements

NUH management have enviable previous experience in the hearing industry will be valuable in any future product feature and enhancements of IQbuds, allowing them to maintain competitive advantages in dynamic control of sound and enriching the listening experience.

NUH partnership with Curtin University valuable for R&D

NUH has a partnership with Curtin University, to co-develop proprietary technology to be 100%owned by NUH. The university has experience in research and development into advanced audio digital signal processing technologies, hearing augmentation, and spatial placement.

NUH will retain 100% of any IP developed from research. In return, NUH will fund the University’s post doctorate positions for $0.3M over 24 months; pay a royalty to Curtin University up to a total of $1M; and grant a license to the university to use IP resulting from research for non-commercial purposes. Sven Nordholm and Prof Kevin Fynn will supervise the project, including design, development, and testing of processing techniques developed.

ReadWrite Labs

NUH has partnered with ReadWrite Labs (formerly Wearable World Inc) world’s leading incubator of wearables technology based in San Francisco. Has incubated over 50 wearable technology companies in last two years. NUH’s David Cannington is ReadWrite Labs’ cofounder. It is dedicated to supporting startups, educating markets, and bringing together network of hardware and software partners.

Convergence likely has begun

We believe that the multi-functionality of smart earbuds is leading to some convergence or blurring of distinction between the various segments, especially around Bluetooth, with audio that can stream to both hearing aids and earbuds. The last made it possible for separate audio between earbuds without need for cable. We believe this blurring will probably become more pronounced in the future. For example future earbuds may effortlessly stream music, connect to smart devices, modify all manner of sounds, provide hearing protection, health, and function as hearing aid. Voice recognition is key where manual interaction with smartphone is reduced giving more power to voice than hand. Earbuds are most logical receptor of the voice. The alliance between leading hearing provider Starkey and earbud startup Bragi is an example.

WHO ARE IQbuds’ CUSTOMERS?

Consumers likely be mostly those wanting wireless and hands-free connection smartphones and other devices, as well as those suffering some hearing loss that may not be ready for full hearing aid.

We expect IQbuds to appeal to broad range of consumers, who can be segmented according the underlying reasons for adopting the earbuds. For some – especially those with hearing problems – it can no less than improve their quality of life. Since January 2016, NUH has tested IQbuds with thousands of consumers in Australia and USA in environments, such the street, cafes, restaurants and has had positive feedback.

Consumers wanting to connect with devices wirelessly via portability and without hands.

These are consumers who appreciate no more wires. They also desire the earbuds to connect with mobile phones and other smart devices, as well as to function without them. The portability, compactness, reduced conspicuousness, and freeing of hands that earbuds offer should attract users to the IQbuds as opposed to wireless headphones.

For example, we would expect people wearing IQbuds would be more approachable by others in social situation than if they were wearing headphones, which suggest being removed “in your own world”. Also earbuds have the advantage of laying claim to be the latest in wireless hearing technology, whereas headphones are still have a design connection to the old wired models. One would have found hard to imagine the character played by Joaquin Phoenix in the film Her using a headphone as opposed to an earbud.

NUH estimates this segment to be >100M consumers in North America and Australia, comprising people aged 25-55

Consumers suffering some hearing loss who are not ready for a hearing aid or desire a lower cost, more socially acceptable solution.

We anticipate mild to moderate hearing loss sufferers who either do not want to spend between US$2k to US$5k on expensive hearing aids, or are not quite ready to have a full blown hearing aid but desire improved hearing will find using IQbuds more appealing. The product would improve their quality of life, making users feel less disconnected, and more capable to understand conversations.

NUH is targeting 50M users in USA and Australia – or 15% of their populations – that have hearing issues and like a “cool” device to augment hearing, that does not have the stigma of a hearing aid. These consumers may experience some hearing issues in day-to-day experiences, may have even mild hearing loss, but have not been diagnosed with a hearing disorder or been recommended (or desire) a hearing aid. While aids have become smaller and more discrete and unnoticeable, still have the attached stigma of being diagnosed with hearing loss. Once diagnosed, consumers take ten years to buy first hearing aid (Davis, Smith, Stephens, Gianopoulos, 2007)

Users are typically over age of 35. However there is anecdotal evidence that hearing loss is occurring at younger ages with loud music a key factor. WHO estimates 1.1b people under age of 30, or 15% of world’s population, have serious risk of hearing loss.

Consumers wishing to reduce noise in an industrial, business, or social settings.

We live in a noisy world. Music can be pervasive not just at concerts, but at bars, clubs, gyms, sporting venues, cafes, events, shopping malls. Then there is a whole range of other noise – vehicle traffic, crowds – that impinge on quality of listening in various situations. IQbuds’ ability feature to reduce or cancel noise while amplifying relevant sound – especially speech – that would attract consumers in a noisy social or an industrial settings. For example conferences, crowded events, gyms, restaurants, airplane, street etc.

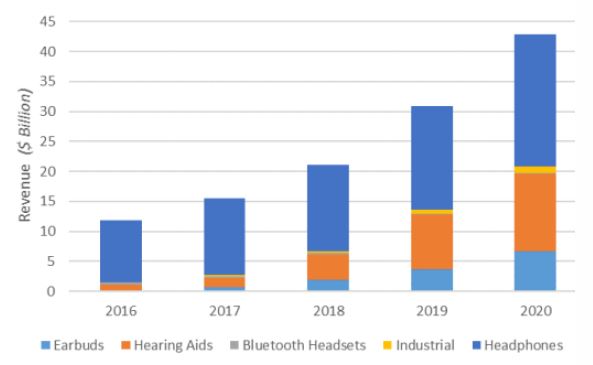

HEARABLES MARKET SIZE – AS HIGH AS US$43B BY 2020

Earbuds have been forecast to be a US$6b market in 2020.

Of the reports on the hearables markets and forecast growth, the most comprehensive into hearables as we define them – wireless and smartly connective – is by WiFore (whose principal Nick Hunn coined the term back in 2014 along with Apple). It predicts the hearables market to reach US$43b in 2020, up from US$12b, representing CAGR of 37%.

While the market is currently dominated by headphones, WiFore envisages earbuds and hearing aids to expand. Factors include more hearing aids encompassing Bluetooth connectivity to smart devices, more wireless headphones replacing wired headphones, and earbuds also driven by the replacement of wired headphones as well their portability, compactness, and Apple’s entry into the market accelerating adoption. Major applications of hearables will be fitness, gaming, virtual reality, music, video, entertainment, treating hearing loss, and listening, and doing more with voice and ears rather than hands, freeing up the latter for other activities.

By value, earbuds will have only 14% of market, well behind headphones (53%) and hearing aids (31%). Implies average pricing of US$1,300 per hearing aids; $75 for headphones; and $100 or earbuds.

Consumers likely be mostly those wanting wireless and hands-free connection smartphones and other devices, as well as those suffering some hearing loss that may not be ready for full hearing aid.

Figure 5: Hearables Market Size

Source: WiFore.

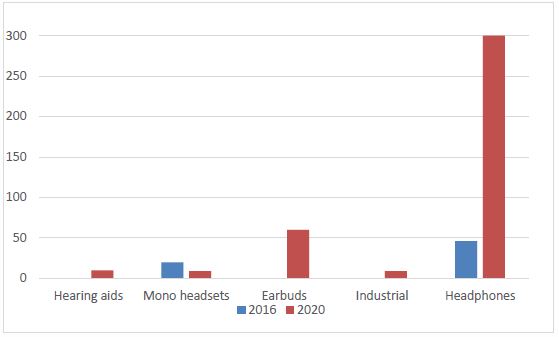

In terms of units, WiFore predicts in 2002 hearables sold will comprise 10M hearing aids, 60M earbuds sales, and 300M wireless headphones. Assumes earbud sales would accompany 4% of smartphone sales (estimated to be 1.5b in 2020) – still relatively low penetration.

Source: WiFore; Foster Stockbroking estimates.

By units, WiFore estimates hearable shipments should reach over 380M units in 2020, dominated by headphones which would comprise 77% of shipments, with earbuds following with 60M, or 15% of market.

Other sources have lower forecast market size than WiFore, primarily due to excluding the hearing aid portion of market. These include:

- Grand View Research: US$20.5b by 2024, for earbuds and headphones;

- Global Market Insights Inc: US$18.2b by 2023 with 470M units shipped. This includes non-Bluetooth and wired hearables;

- Future Market Insights: US$24.1b by 2025;

- ReadWrite US$16b by 2020; and

- Technavio US$17b by 2019.

Overall, we assume a mid-point estimate for the hearables market – between the high of WiFore’s US$43b estimate and the low of ReadWrite’s US$$16b – is US$30b.

HEARABLES AND OTHER WEARABLES – SAME OLD OR DIFFERENT?

Hearables offer immediate, real-time benefit to sensory experience unlike other wearables.

Hearables have been lumped together with other wearables such as those worn on the eyes (eg Google glass) and wrist (eg Smartwatch, fitness trackers). With some of these, the initial novelty and excitement around new technology is not sufficient in itself to sustain consumer interest, with the risk that once disinterest sets in the products are confined to the drawer.

Pebble’s and Fitbit’s recent struggles highlight that as novelty is diminishes, it unmasks the device’s lack of immediate and gratifying functions. However we see key differences that we believe hearables will not follow the same path.

Hearables offer immediate gratification

A key problem with wrist wearables is the focus on data analytics and feedback. While useful, it does not provide immediate gratification – one needs to actually accumulate fitness data and then act on it, all of which can take time, be monotonous, and may not yield the desired result. Hearables such as IQbuds instead offer immediate gratification, be it ability to hear clearly, cancellation of unwanted noise, ability to listen to music.

[/av_three_fourth]

Hearable enhance the sensory experience

Unlike other wearables, hearables immediately enhance the experience of hearing, one of the five physical senses. IQbuds allow the user to control hat they wish to hear and how to hear it, and just as importantly, what they do not want to hear (unwanted noise).

Problem solving instantly

Finally hearables solve problems immediately. While other wearables can solve problems, these are over time and usually require gathering sufficient data and then acting upon it, placing a premium on the consumer’s patience and persistence. A hearable offers immediate , real-time benefits for those that are hearing impaired, wish to hear more clearly, or block out noise, as well as to free their hands by using their voice

NUH’s MARKETING AND DISTRIBUTION

Initial online campaign on Indiegogo yields over 4k pre-orders

NUH has adopted a staged approach to marketing its IQbuds. The first stage comprised a low cost, pre-order campaign where interest and excitement was built around the product launch, including social media. The campaign commenced April 2016, managed through the Indiegogo.com online platform, which is used by a range of companies to launch products and assess product market fit. NUH had databases of over 20k people signed up, had 21k likes on facebook.

During the campaign over 4k IQbuds pairs, equal to over $1M, or >US$0.75M, were received in pre-orders from 3.5k supporters across 82 countries. Over 60% of sales were in Canada and USA, other leading customers countries were Australia, UK, Japan, and Germany. In October 2016, the company also launched its own online store and started accepting pre-orders for 3QFY17.

The company promoted a referral program and magical listening tour visiting major cities in US, Canada, and Australia. Further promotion will be public relation, media, trade shows, and social media advertising.

Hard launch to be at Consumer Electronics Show January 2017

After the December 2016 soft launch, the major launch will be held in January 2017 at the Consumers Electronics Show (CES) in Las Vegas (www.ces.tech). NUH has received forward orders from selected retailers in the USA and Australia, and in the next few months it will announce agreements with distributors and retailers in these key markets.

Wynit is first major distributor signed

First major US distributor signed

The second stage will comprise significantly expanding distribution channels. This will encompass the NUH website and e-retailers. A key first signing was Wynit Distribution appointed as distributor for North America. Wynit is a leading North American wholesale and distribution company with significant experience in distributing emerging technology products for leading brands (e.g. Fitbit, Garmin, Polar, TomTom, and Pebble). NUH will benefit from Wynit’s extensive relationship and established distribution network with major retailers like Wal-Mart, Best Buy, Target, down to smaller independent retailers.

E-tailers would include those selling electronics, telecommunication devices, and wearables. This will be gradually expanded to bricks and mortar retailers in including consumer electronics, specialty retail/duty free, pharmacies, audiologist practitioner and hearing chains.

NUH has stated that over 100 global distributors and retailers have also showed interest in the product, and that it has received forward orders from selected retailers in USA and Australia.

While the focus is initially in the USA, we expect NUH will eventually establish diversified retail and distribution partners in Australia, North America, Middle East, RSA, and Europe.

MANUFACTURING AND LOGISTICS – WORLD CLASS CONTRACTOR

Product shipping to begin by end of 2016.

Flextronics a coup for NUH

NUH selected Flextronics International to manufacture IQbuds, the second largest global electronics manufacturer after Taiwan’s Foxconn. The benefit of using Flextronics is that it will also provide shipping, logistics and warehousing facility, saving substantial capital expenditure for NUH, which can instead be diverted towards more marketing, sales, research and development. Flextronics has over 100 facilities in 30 countries around the world, bringing production closer to customer markets, and thus improving margins.

Flextronics designs, builds, and services complete packaged consumer and industrial products for some of the world’s largest OEMs incluidng Fitbit, Apple, Cisco, HP, Lenovo, Microsoft, Ericsson, and Huawei.

[/av_three_fourth]

Flextronics has commenced manufacture of tooling, development of production testing equipment, pilot production runs, reliability and compliance testing of the IQbuds. We expect initial early supporter production run and shipment to commence in December 2016, with manufacture and shipping ramp up in January/February 2017.

IQbuds have been shipped to third party certification for USA, Canada, Europe, Australia/NZ. Expected by end of year.

Product shipping– December 2016

IQbuds were beta tested with hundreds of users after first working prototypes were produced in January 2016. NUH expects first commercial final IQbuds product to be shipped end 2016, the first being delivered to fulfill preorders of during the 2016 Indiegogo campaign.

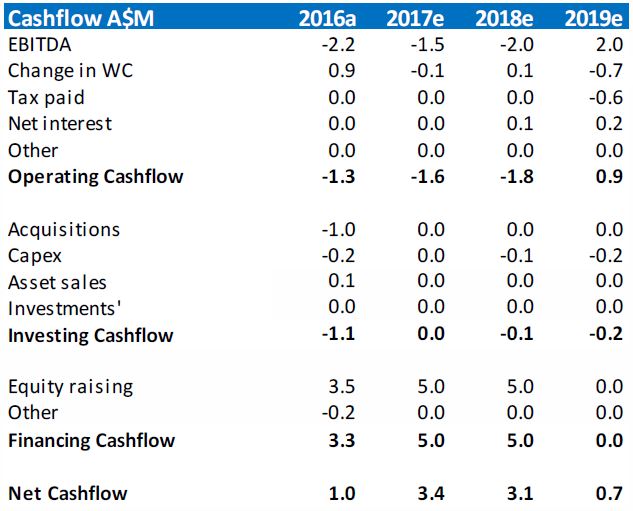

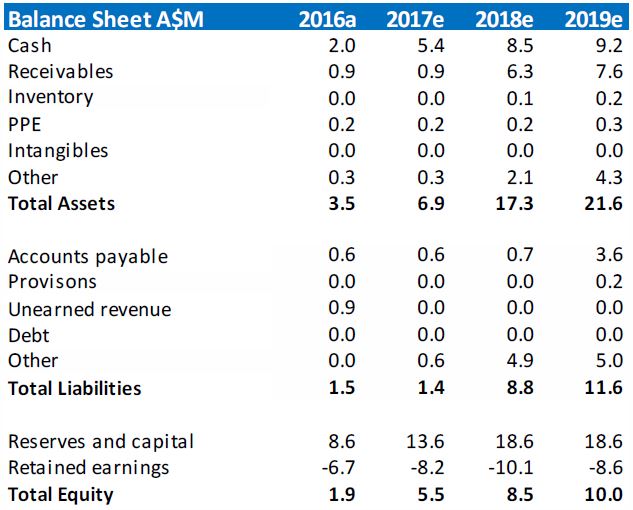

EARNINGS FORECASTS

We forecast losses in FY17e and FY18e as NUH ramps up. We expect breakeven NPAT in FY19e.

We forecast NUH will make losses from FY17e and FY18e, as it will be still be in the early stages of revenue growth and ramp up. We expect focus on the market will be more on sales growth, as an indication of consumer acceptance of the product. Our complete earnings estimates are summarised on page 2.

Forecast maiden NPAT in FY19e

We forecast maiden NPAT in FY19e of $1.0M. We EBIT expect margin to gradually improve over the period FY17e to FY21e as the company ramps up scale, settling at a long-term value of 15%, in-line with peer average. We believe our assumptions are conservative, as to date NUH has demonstrated efficient spend on marketing and research development to get to the stage of approaching first sales.

At least $1M sales should be booked in FY17e, we forecast $3M

We forecast sales of $3M (7.5k units) in FY17e, $19.9M (50k) in FY18e and $39.9M (100k) in FY19e. We note that Bragi following launch sold 100k units in its first six months, while Forbes has quoted a revenue estimate for Doppler Labs of US$100m in 2017. So we expect our assumption are relatively conservative. Also, ca. $1M of the $3M in sales are from existing pre-orders awaiting shipment.

We forecast the company to begin generating net free cashflow in FY20e. Key underlying assumptions is that that the hearables market will reach US$30b in 2020. Of this earbuds will comprise 13% of the market value, or US$4b. We assume IQbuds will penetrate 1.9% of the earbud market, or reach $100M in sales by then.

Figure 7: NUH Sales and market share

Source: Foster Stockbroking estimates.

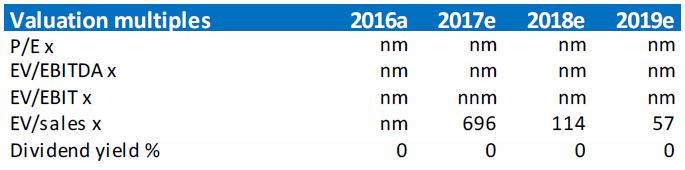

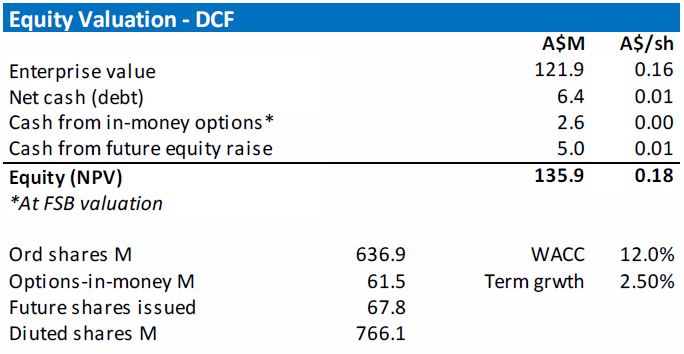

NUH VALUATION – $0.18/SHARE

We value NUH at $0.18/share using NPV12 and terminal growth rate 2.5%.

We value NUH at $0.18/share derived from a DCF using 12% WACC and terminal growth of 2.5%. Our major assumptions include:

- Long-term EBIT margin of 15% reached in FY21e, based on average for wearables and hearing companies;

- Hearables market will reach US$30b in 2020.

- Earbuds will comprise 13% of the market value, or US$4b.

- IQbuds penetrating 1.9% of the earbud market, or reach $100M in sales, by FY20e.

- Long-term A$ of US$0.75.

Our valuation also assumes the company raise a further $5M in FY18e as part of ramping up to profitability.

Figure 8: NUH Valuation $M

Peer valuation shows NUH valuation upside

Recent earbuds startups Bragi valuation has been estimated $175M von $22M raised in 2015, and Doppler Labs $150M on $24M July 2016 raise (source: NUH). These valuations highlight the upside potential for NUH, especially once the company commences shipping product.

RECOMMENDATION – SPECULATIVE BUY, PRICE TARGET $0.18/SHARE

We initiate with Speculative Buy recommendation and price target of $0.18/share.

We initiate with Speculative Buy recommendation and price target of $0.18/share based on our blended valuation.

We expect catalysts for NUH to include:

-

- First commercial shipment of IQbuds

- First commercial sales of IQbuds

- Successful launch of IQbuds at CES Las Vegas

- Positive reviews of product in print and online journals

- Distribution by Wynit of product to major US retailer

- Further distribution and retail partnership in USA and other geographies.

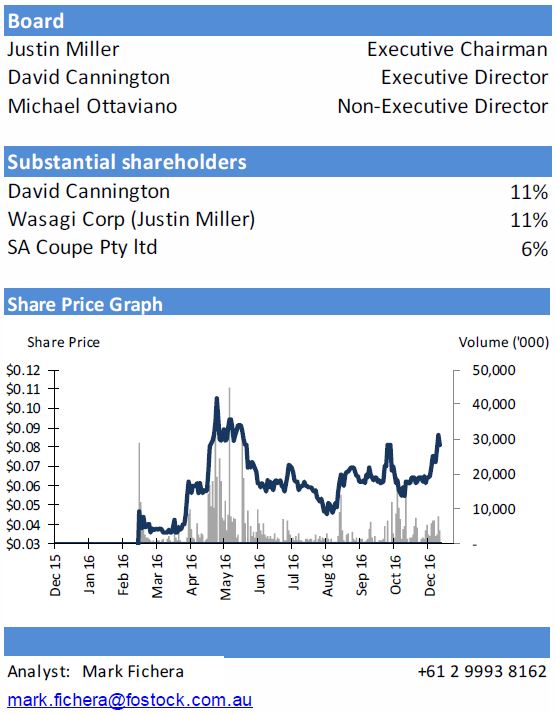

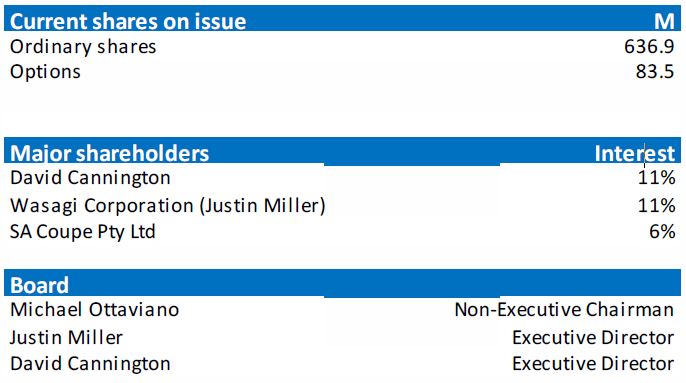

Board

Mr Justin Miller. Executive Director, Chairman, Co-Founder, CEO. A serial entrepreneur, has extensive experience and understanding of the hearing technology and global innovation market during his 25-year executive career. Most recently was founder and CEO of industrial hearing and communication company, Sensear (smart communication and hearing protection products), growing business globally from San Francisco. Also founded ASX-listed IT company Empired Ltd.

Mr David Cannington. Executive Director, Co-founder, Executive Vice President Sales & Marketing. Over 25 years global sales and marketing experience, including for consumer goods (Cadbury Schweppes); advertising (McCann Erickson); and data analytics (Neochange) and hearing technology (Sensear). Founding CEO of ANZA Technology Network. A seasoned international sales and marketing executive with experience across the consumer and technology sectors. Based in San Francisco, has previous experience advising many start-ups go-to-market and growth strategies.

Mr Michael Ottaviano. Non-Executive Director, BEng, MSc, MAICD, MIEngAus. CEO of ASX-listed Carnegie Wave Energy Ltd since 2007, leading its development of wave energy technology from proof of concept to commercial demonstration. Previously worked in R&D and manager for Australian engineering company. Prior to Carnegie, was senior manager specialising in technology and innovation consulting for global accounting and advisory firm.

Key Management

Sven Nordholm, Co-founder, Chief Technologist. Phd in signal processing from Lund University, Sweden. Since 1999 a Professor at Curtin University, Perth, WA, and founding member of Hearmore and Sensear Pty ltd (2006). Holder of 7 patents and 30 years research in signal processing. Contributed to 200 technical papers.

Professor Kevin Fynn. Co-Founder, Chief Scientist. Professor and Head of School of Electrical Engineering and Computing Curtin University of Technology. Distinguished research engineer, engineering manager, and electrical engineering practitioner. Director of Western Australia Telecommunications Research Institute. Has 8 patents and over 50 publications. Co-founder of Xelor, Sensear, TheBuzz Corp, Hearmore (instrumental in setting up a new hearing aid distribution model through pharmacies and audiology support clinics) and MobiRoam.

Risks

Branding risk. NUH and IQbuds’ brand may fail to gain traction in the market, inhibiting sales growth required for profitability.

Competition risk. Existing or new competitors in hearing technology may offer more attractive products for consumers, making it harder for NUH to attract new customers lose existing ones.

Technology risk. Changes in technology may cause NUH’s products to become obsolescent or less attractive, causing it to lose customers.

Economic risk. Any downturn in the US or global economies may cause less consumer spending on NUH’s products, impeding growth and earnings.

Funding risk. NUH may require further funds to grow its business. However any risk aversion in providing funds may make it difficult for NUH to access funds, or may result in NUH issuing equity on a dilutive basis, negatively impacting shareholders.

Litigation risk. NUH may be subject to legal action, by customers, suppliers, vendors, governmental agencies or third parties. NUH may also be required to incur significant expenses in monitoring and protecting its intellectual property rights and may initiate or otherwise be involved in litigation against third parties.

Partner risk. A termination of NUH’ agreement with Curtin University may damage the company’s research and development, and ability to grow and enhance its products.

FOSTER STOCKBROKING DIRECTORY & DISCLAIMERS

Foster Stockbroking recommendation ratings: Buy = return >10%; Hold = return between –10% and 10%; Sell = return 20% for stock with very high risk. All other ratings are for stocks with low-to-high risk. Returns quoted are annual.

Disclaimer & Disclosure of Interests. Foster Stockbroking Pty Limited (Foster Stockbroking) has prepared this report by way of general information. This document contains only general securities information. The information contained in this report has been obtained from sources that were accurate at the time of issue. The information has not been independently verified. Foster Stockbroking does not warrant the accuracy or reliability of the information in this report. The report is current as of the date it has been published.

In preparing the report, Foster Stockbroking did not take into account the specific investment objectives, financial situation or particular needs of any specific recipient. The report is published only for informational purposes and is not intended to be advice. This report is not a solicitation or an offer to buy or sell any financial product. Foster Stockbroking is not aware whether a recipient intends to rely on this report and is not aware of how it will be used by the recipient. Investors must obtain personal financial advice from their own investment adviser to determine whether the information contained in this report is appropriate to the investor’s financial circumstances. Recipients should not regard the report as a substitute for the exercise of their own judgment. The views expressed in this report are those of the analyst/s named on the cover page. No part of the compensation of the analyst is directly related to inclusion of specific recommendations or views in this report. The analyst/s receives compensation partly based on Foster Stockbroking revenues, including any investment banking and proprietary trading revenues, as well as performance measures such as accuracy and efficacy of both recommendations and research reports.

Foster Stockbroking believes that the information contained in this document is correct and that any estimates, opinions, conclusions or recommendations are reasonably held or made at the time of its compilation in an honest and fair manner that is not compromised. However, no representation is made as to the accuracy, completeness or reliability of any estimates, opinions, conclusions or recommendations (which may change without notice) or other information contained in this report. To the maximum extent permitted by law, Foster Stockbroking disclaims all liability and responsibility for any direct or indirect loss that may be suffered by any recipient through relying on anything contained in or omitted from this report. Foster Stockbroking is under no obligation to update or keep current the information contained in this report and has no obligation to tell you when opinions or information in this report change.

Foster Stockbroking and its directors, officers and employees or clients may have or had interests in the financial products referred to in this report and may make purchases or sales in those the financial products as principal or agent at any time and may affect transactions which may not be consistent with the opinions, conclusions or recommendations set out in this report. Foster Stockbroking and its Associates may earn brokerage, fees or other benefits from financial products referred to in this report. Furthermore, Foster Stockbroking may have or have had a relationship with or may provide or has provided investment banking, capital markets and/or other financial services to the relevant issuer or holder of those financial products. For an overview of the research criteria and methodology adopted by Foster Stockbroking; the spread of research ratings; and disclosure of the cessation of particular stock coverage, refer to our website http://www.fostock.com.au.

Specific disclosures: The analyst, Foster Stockbroking and/or associated parties have material beneficial ownership in securities issued by NUH at the time of this report. Diligent care has been taken by the analyst to maintain an honest and fair objectivity in writing the report and making the recommendation.

Specific disclosures: Foster Stockbroking is engaged by NUH to provide corporate services for which it may earn fees. Foster Stockbroking acted as Joint Lead Manager to the $5.0M placement of 83.1M NUH shares in September 2016. Foster Stockbroking received fees for this service.